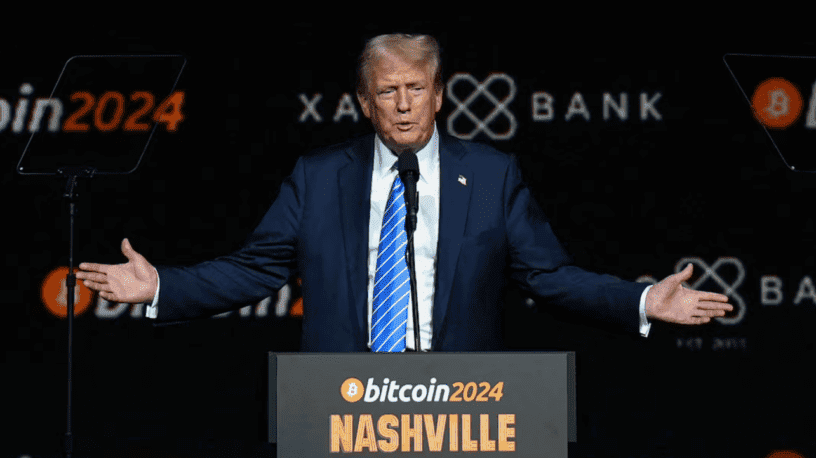

Trump’s Victory and Its Global Impact on Cryptocurrencies

Donald Trump’s victory in the 2024 U.S. presidential election has had a significant impact on the global cryptocurrency market. His return to the White House has reignited discussions about the future of digital assets, regulation, and financial innovation. With a political approach that tends to favor deregulation and free-market policies, many investors and analysts see his administration as an opportunity for cryptocurrencies to thrive.

Shortly after his victory was confirmed, the cryptocurrency market experienced a strong rally. Bitcoin, the leading digital asset, surpassed the $100,000 mark for the first time in history. This milestone was seen as a reflection of renewed confidence in a more favorable regulatory environment for cryptocurrencies under Trump’s leadership. The broader market, including Ethereum and other altcoins, also saw significant gains as optimism spread.

Trump has long been known for his skepticism toward traditional financial institutions and government oversight. During his campaign, he expressed a willingness to create a more crypto-friendly landscape in the U.S., promising to reduce bureaucratic obstacles and encourage innovation in the sector. This stance contrasts sharply with the approach taken by the previous administration, which had intensified regulatory scrutiny over the industry. Many crypto advocates see this shift as an opportunity to establish the United States as a leader in digital finance.

One of the first actions taken by the new administration was an executive order aimed at fostering the growth of the cryptocurrency sector. This order outlined plans to form a dedicated task force to oversee digital asset markets, aiming to provide regulatory clarity while promoting responsible innovation. Many in the industry believe that such measures could attract more institutional investors and encourage mainstream adoption of cryptocurrencies.

Another significant move by Trump was the appointment of Paul Atkins, a well-known advocate for financial deregulation, as the new chairman of the U.S. Securities and Exchange Commission (SEC). This decision was widely celebrated by crypto enthusiasts, as Atkins has historically been in favor of reducing regulatory restrictions on digital assets. His leadership at the SEC is expected to bring a more lenient approach to cryptocurrency regulations, potentially leading to the approval of more financial products such as Bitcoin ETFs and other crypto-based investment vehicles.

The global impact of these policy shifts is already being felt. Countries around the world are closely watching the U.S. to see how it navigates the regulatory landscape under Trump’s leadership. If the U.S. adopts a more open stance toward digital assets, it is likely that other nations will follow suit in order to remain competitive in the rapidly evolving financial landscape. The potential for widespread adoption of cryptocurrencies has never been more evident, and market participants are eagerly awaiting further developments.

Despite the optimism, some analysts warn that an overly aggressive push toward deregulation could bring risks. The cryptocurrency market has historically been highly volatile, and excessive speculation without proper safeguards could lead to financial instability. Past bubbles, such as the 2017 ICO craze and the 2022 crypto winter, serve as reminders that rapid growth must be accompanied by responsible management. If Trump’s administration fails to strike a balance between innovation and risk mitigation, the consequences could be severe.

Another concern among skeptics is the potential for increased institutional influence over the cryptocurrency space. While regulatory relaxation could encourage traditional financial institutions to enter the market, some fear that this could lead to centralization, undermining the original decentralized ethos of cryptocurrencies. The challenge for policymakers will be to create an environment that fosters growth while preserving the core principles that make digital assets unique.

As the world watches the unfolding developments, one thing is certain: Trump’s presidency has reignited enthusiasm in the crypto space. Whether this leads to sustained growth or another cycle of speculation remains to be seen, but the impact of his administration on digital finance will undoubtedly be felt for years to come. Investors, developers, and regulators will need to navigate this new era carefully, ensuring that innovation is balanced with long-term stability.