Read to Get Richer: The Best Crypto and Finance Books Every Modern Investor Should Know

In the digital age, where financial markets evolve at lightning speed and cryptocurrencies dominate headlines, staying informed is not just a recommendation—it's a necessity. While many people rely on Twitter threads, YouTube videos, and quick news updates for financial insights, there's something uniquely valuable about sitting down with a well-researched, well-written book. Books offer depth, clarity, and context that short-form content often lacks. If you're looking to truly understand the forces shaping today’s economy and tomorrow’s financial future, reading the right material could be your most profitable investment.

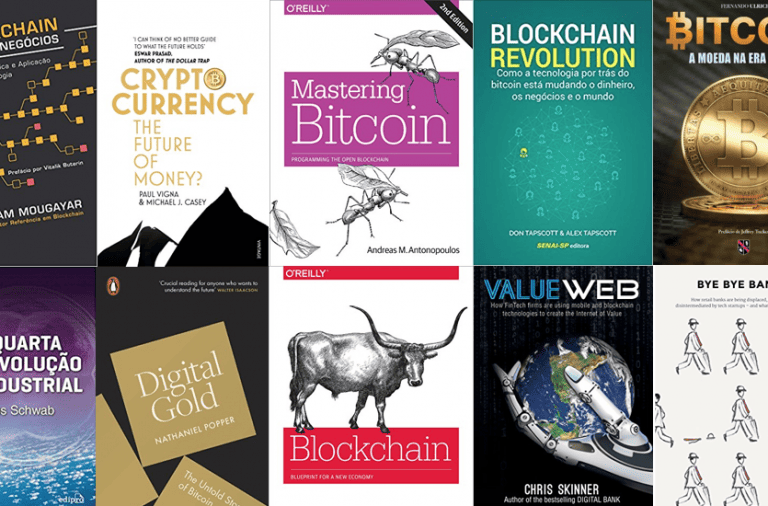

Over the past few years, the explosion of interest in Bitcoin and other cryptocurrencies has given rise to a wave of books focused on blockchain technology, digital assets, decentralized finance (DeFi), and investment strategies. For newcomers, these books can serve as a compass, pointing the way through a complex, volatile landscape. For seasoned investors, they offer new perspectives and critical frameworks that can sharpen strategies and reduce risks. But not all books are created equal. Below are some of the most valuable titles that every aspiring investor, trader, or crypto enthusiast should read—and more importantly, truly understand.

If you're new to the crypto world, the perfect starting point is “The Bitcoin Standard” by Saifedean Ammous. More than just a technical explanation, this book explores Bitcoin’s role as a potential replacement for traditional currencies. The author traces the history of money from ancient societies to modern banking, highlighting the flaws of fiat systems and central banks. Through compelling arguments, Ammous shows how Bitcoin, with its fixed supply and decentralized nature, could represent a return to sound money principles. Whether or not you agree with all of his views, the book challenges your thinking and presents a strong philosophical foundation for understanding why Bitcoin exists and why it matters.

Beyond Bitcoin, there’s a growing world of crypto assets—from Ethereum to Solana, from governance tokens to NFTs—and navigating this broader ecosystem requires a different level of knowledge. That’s where “Cryptoassets” by Chris Burniske and Jack Tatar becomes essential. This book dives into how digital assets can be classified, valued, and invested in as part of a modern portfolio. The authors introduce readers to fundamental analysis tailored specifically for crypto, discuss security practices, and provide a structured approach to evaluating new projects. It’s a practical guide with real examples, helping readers move from speculation to strategy.

If you're someone who prefers to understand how things work under the hood, then “Mastering Bitcoin” by Andreas M. Antonopoulos is a must. This technical guide doesn’t just tell you what Bitcoin is—it shows you how it works at a protocol level. Antonopoulos is a well-known educator in the crypto space, and his writing style makes complex concepts like cryptographic keys, digital signatures, proof-of-work, and blockchain synchronization accessible even to those without a computer science background. For developers or aspiring entrepreneurs in the Web3 space, it’s practically a blueprint.

But let’s not forget that cryptocurrency is just one piece of the larger puzzle. Building wealth sustainably also requires understanding traditional financial systems and how personal mindset influences success. That’s why many successful crypto investors also draw from timeless financial books like “Rich Dad Poor Dad” by Robert Kiyosaki. While it’s not about crypto, its core message about assets versus liabilities is incredibly relevant. Kiyosaki encourages readers to break free from the traditional “9-to-5 and save” mindset and instead focus on acquiring assets that produce passive income. Bitcoin and crypto, in many ways, align with his philosophy, as they represent non-traditional vehicles for building wealth independently.

Another foundational book in the finance world is “The Intelligent Investor” by Benjamin Graham, often considered the father of value investing. Even though Graham wrote the book decades ago, the principles of patience, margin of safety, and emotional discipline are more relevant than ever—especially in a space as volatile as crypto. Applying these traditional investment strategies to the modern world of digital assets can help investors avoid costly mistakes and recognize when a coin or project is overvalued or undervalued.

For those who enjoy narratives over numbers, “Digital Gold” by Nathaniel Popper provides a riveting history of Bitcoin’s early days. This isn’t a technical manual or a strategy book—it’s a story, and a very human one at that. Popper tracks the journeys of the cypherpunks, libertarians, and tech outsiders who embraced Bitcoin when few others took it seriously. From underground message boards to Wall Street interest, the book shows how a fringe idea grew into a global movement. For readers who want to understand the passion, conflict, and drama behind the headlines, Digital Gold is a compelling read.

What ties all these books together is their power to educate and empower. In a market where misinformation spreads fast and hype often overshadows substance, taking time to learn from trusted sources is a strategic advantage. The crypto world moves quickly, and without a firm foundation, it’s easy to get swept up in trends or scams that promise quick returns but deliver long-term loss.

Reading helps you slow down. It forces you to think critically, absorb new perspectives, and develop your own investment philosophy. While no book can predict the next bull run or shield you from all risks, the knowledge you gain will help you stay grounded during market swings, spot legitimate opportunities, and make decisions based on logic rather than emotion.

This is especially important as crypto expands beyond currencies into areas like gaming, digital identity, decentralized governance, and even art. The rise of Web3 means investors now have access to ecosystems where ownership, utility, and community intersect. Understanding the implications of these shifts requires more than just browsing news headlines—it demands deep learning and continuous adaptation.

Whether your goal is to trade full-time, earn passive income through DeFi, or simply understand how money is changing in the 21st century, building a habit of reading is one of the smartest moves you can make. These books offer the insights, stories, and strategies that can guide you toward not just wealth, but financial confidence and independence.

So the next time you think about what to do with your free time, consider putting down the screen for a moment and picking up a book. In a world where financial freedom feels increasingly out of reach, the right words on the page can bring you one step closer to achieving it.